The Importance of Risk Management

It has been a long time, I have not been able to prepare new posts due to my busy schedule. Today i will try to talk about the importance of risk management, which is an important issue for us in all areas of life, but most people are not even aware of it. Risk management is a subject that we need in all areas of life, but it is probably one of the most important elements for a trader or investor. I would say that proper risk management will be responsible for at least more than 50% of your success.

I took courses on risk management even at university and as a result, i came to the conclusion that this is an experience that can best be gained through experience, even by taking risks and experiencing losses as a result. Later, the importance of risk management started to increase for me and i started to play the game according to the rules. Based on my own experience, i can say that there is no fixed rule on risk management because everyones budget, the risks they will take and the things they will lose differ. A risk that you can take does not mean that someone else can take that risk, even your psychological state at that moment will affect the risk you will take.

In fact, even if you don't know how to manage risk, even if you have no experience at all, what basically leads you to lose is greed. The ambition to earn more drives you to greed and causes you to lose what you have. We call this FOMO (fear of missing out). There may be people who want to hunt you down and target the money you're risking, but that's where the game starts and that's where you start to see the real importance of risk management.

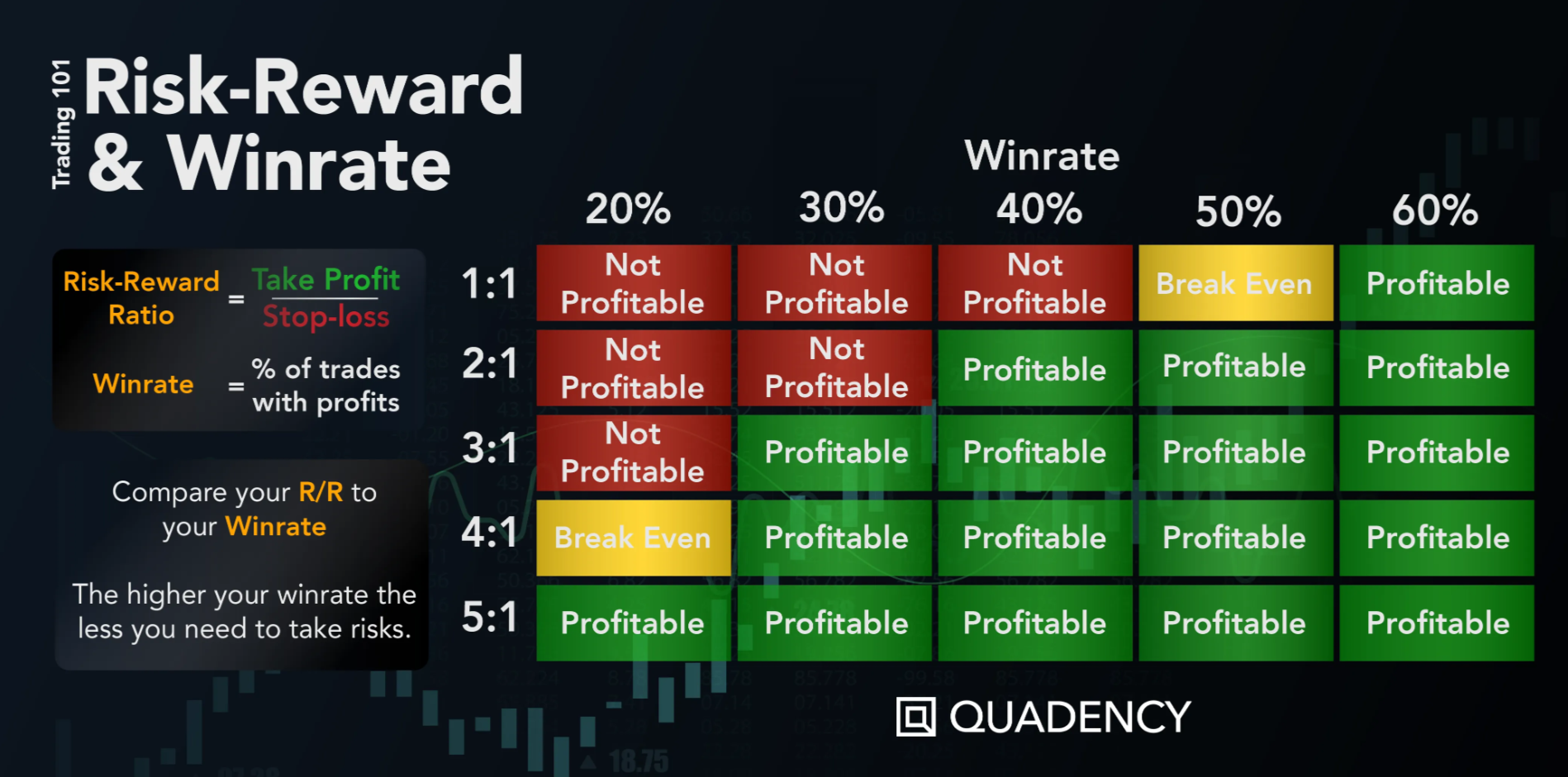

Without getting too confusing, i need to talk about basically how your risk management should work because you have already heard the popular sayings like don't put all your eggs in one basket. Basically, even if you pay attention to these things, you may lose in total, but at least it wont completely wipe you out and you won't have to start from scratch. In general, the important thing in risk management is to focus on what you have to lose, so determining your risk is very important. The gain will be the reward for taking this risk, so calculating this in the 2nd plan will always give you an advantage and make it easier for you to make a proper risk management.

In general, it is useful to look at statistical data in areas where risk management is used intensively. In my experience, trading is one of the areas where it is used intensively, so it will not be difficult for you to calculate your risk and profit based on the statistics here because you can find a lot of risk management data.

According to my experience, if you are taking a risk that we call 1:1, you should not take it. Establishing your risk management in the form of at least 1:2 will provide you with long-term gains, that is, if you have 1 risk in the risk management you will create, you will need to make 2 gains. I consider 1:4 and above as greed. But it certainly varies according to the events or the sector in which you will take this risk. Still, i don't want to think about the possibility of 1:1, regardless of the sector😊

Even though i have studied this topic in a lot of detail, i didn't want to go into too much detail because i think the foundation is much more important. I hope it was an explanatory and satisfying post.

Kind regards...